Welcome to Prometheus Asset Allocation. The Prometheus Asset Allocation program offers a stable, macro-focused approach to asset management. Prometheus Asset Allocation aims to outperform a traditional stock and bond portfolio by leveraging our proprietary systematic macro process to rotate between 3 ETFs monthly (plus cash). As part of the program, we will be sharing our views on Growth, Inflation, and Liquidity in addition to our monthly video updates.

Our primary takeaways are as follows:

Our systems place real GDP growth at 1.15% versus one year prior and remain in a sequential downtrend.

While investment remains in a downtrend, we have begun to see some green shoots. Particularly, industrial equipment, motor vehicles, and intellectual property have all inflected upwards. It remains early in these moves, but if continued, they could be meaningful for the outlook.

Overall recession probabilities remain muted, broad-based measures of growth remain stable, and our forecast for future real growth has accelerated. In the context of markets, this is a support for stocks and commodities, but a headwind for bonds, as reflected in our Asset Allocation strategy.

Before, we delve deeper in to the note, you can access our latest asset class views below:

For the latest data through January, our systems place Real GDP growth at 1.15% versus one year prior. Below, we show our monthly estimates of Real GDP relative to the official data:

In January, GDP came in at -0.49% versus the prior month. Below, we show the weighted contributions to the most recent one-month change in real GDP, along with the recent history of month-on-month GDP. Additionally, we show the contribution by sector to monthly GDP in the table below:

In January, real consumption spending decreased by -0.12%. Over the last year, consumption has added 2.18% to GDP growth of 1.15%.

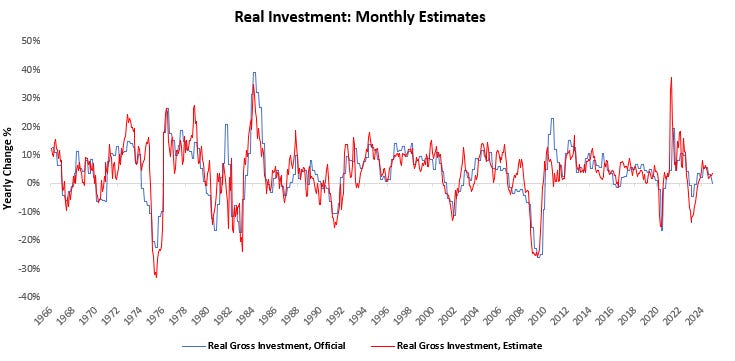

In January, real gross investment increased by 0.17%. Over the last year, investment has added 0.26% to GDP growth of 1.15%.

However, upon looking at the underlying components, we see a sequential acceleration in intellectual property and industrial equipment investment. This is a support for nominal growth conditions. Below we show the contribution of IP investment to NGDP growth on a yearly basis:

Next, we show the contribution of industrial equipment to NGDP:

Lastly, we analyze the contribution of motor vehicles. Transportation spending is a key barometer of business cycle conditions. Currently, transportation spending has begun to improve, showing signs of cyclical expansion in the broader economy.

In January, real government expenditures increased by 0.01%. Over the last year, government spending has added 0.24% to GDP growth of 1.15%.