Welcome to Prometheus Asset Allocation. The Prometheus Asset Allocation program offers a stable, macro-focused approach to asset management. Prometheus Asset Allocation aims to outperform a traditional stock and bond portfolio by leveraging our proprietary systematic macro process to rotate between 3 ETFs monthly (plus cash). As part of the program, we will be sharing our views on Growth, Inflation, and Liquidity in addition to our monthly video updates.

Our primary takeaways are as follows:

In October, GDP came in at -0.01% versus the prior month. This was primarily driven by contributions from consumer spending.

While strong consumer spending continues to contribute steadily to nominal growth, the gap between output and employment remains unsustainable.

Business investment in residential and industrial equipment has also declined sequentially, showing increasing signs of slowing and emerging pressures on profitability.

In the context of markets, equities remain well-supported by a lack of a recession and a strong nominal growth market regime. Meanwhile, bonds and commodities have more mixed drivers. Our Asset Allocation changes will reflect these dynamics.

Today, we share our Growth Views. Below, we show our proprietary Prometheus Growth Index, which offers us real-time insight into the pressures on future growth conditions. This measure remains in the contractionary zone, suggesting stabilization within a slowing economy:

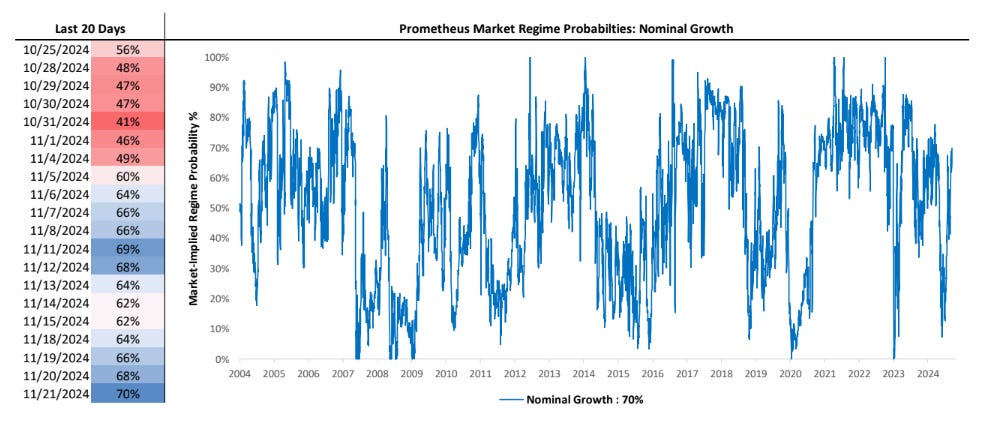

However, while real GDP growth in the economy remains slowing, markets have recently moved to price in rising growth conditions. We show this captured via our proprietary market regime probabilities for nominal growth:

Recall that markets are continuously discounting future probabilities, and using our understanding of cross-asset pricing, we can infer the economic regime being priced into asset markets. This process of regime recognition allows us to understand the probability of a macroeconomic environment as evidenced by cross-asset movements— which allows us to identify the dominant and durable trend in markets. This feature is critical as it allows us to visualize if market probabilities are moving to confirm our expected outlook for the macro-economy on the margin, thus creating opportunities to potentially buy assets as they rise and short them as they fall.

Today, we see a divergence between these market regime probabilities and the macro environment. This has significant implications for asset allocation portfolios. We discuss this in detail below.