Welcome to The Observatory. The Observatory is how we at Prometheus monitor the evolution of the economy and financial markets in real-time. The insights provided here are slivers of our research process that are integrated algorithmically into our systems to create rules-based portfolios.

Over the last decade, US equity market investors have shunned global exposure as US equity markets continued to power ahead. However, as geopolitical tensions escalated in 2025 on the back of tariffs, amidst elevated equity market valuations, we saw a dramatic rotation of capital away from US equities.

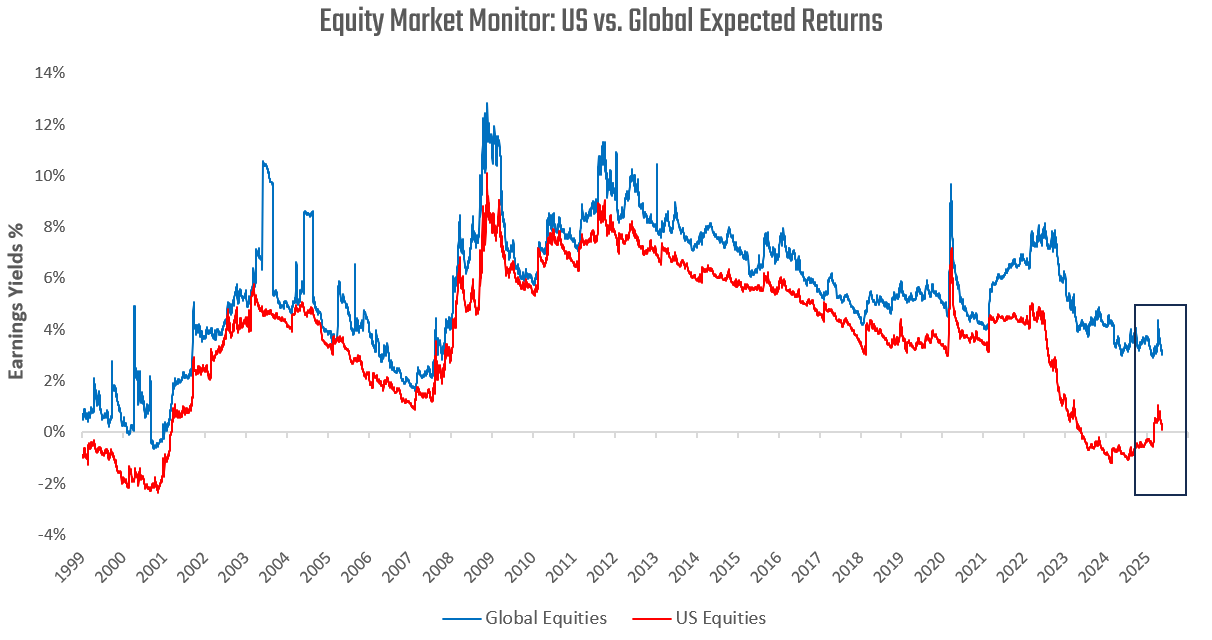

These moves underscore the importance of global diversification at a time when US equities remain extremely richly priced relative to the rest of the world. We think reflecting on these relative price dynamics today is essential, as they are at generational extremes. We visualize this below:

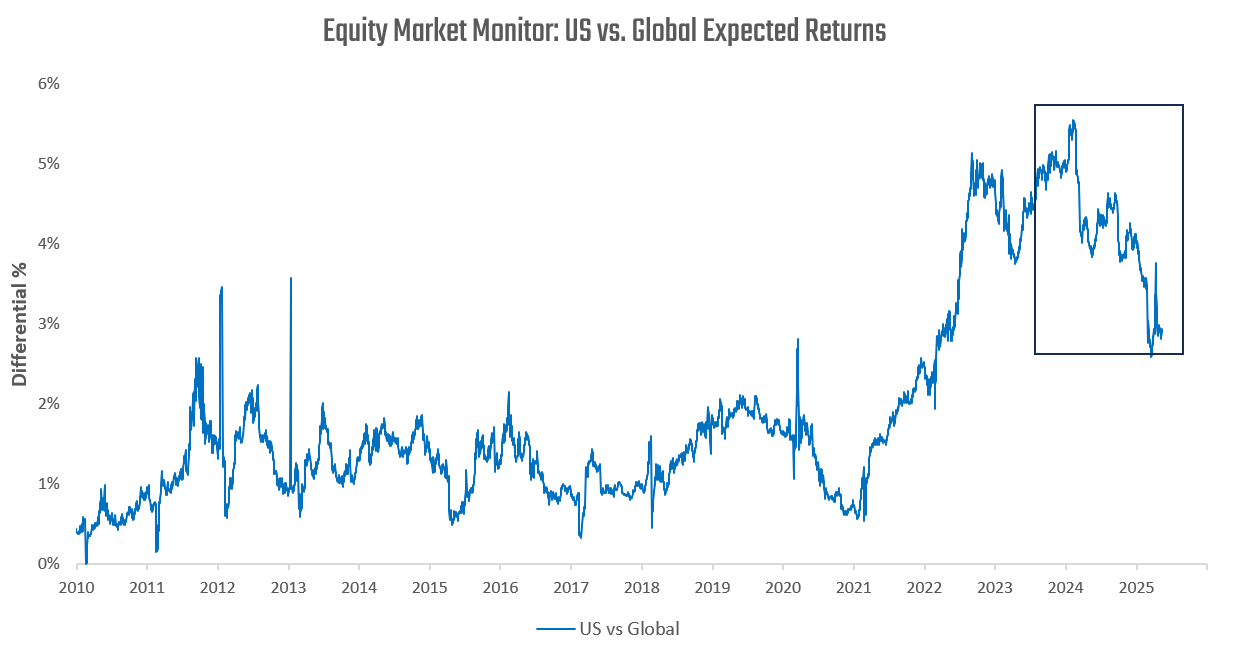

Above, we visualize the expected returns from carry in the form of earnings yields for Global & US Equities. The differential between these carry measures is at extremes we haven’t seen in decades. We isolate the differential below:

While recent price action has narrowed the gap between the US and a broader global portfolio, we think it is crucial to recognize that this headwind persists. Recall that every asset (stocks, bonds, commodities) generates an expected return for a given level of risk. This return can come through two ways: the asset can create a cash flow for simply holding it, like an interest payment or a dividend, or the asset's price can change. If an asset generates positive returns for merely holding it, it has a positive carry. By and large, the most preferable assets to own over the long term are assets that offer a reasonable carry relative to their risk.

Today, US assets by way of stocks (and bonds, but that’s for another time) offer no carry for owning them relative to domestic or international assets. This is a significant headwind, and in fact, potentiates many long-short alpha opportunities. From an asset allocation perspective, it underscores the importance of looking for alternative sources of returns that offer better risk-to-reward characteristics.

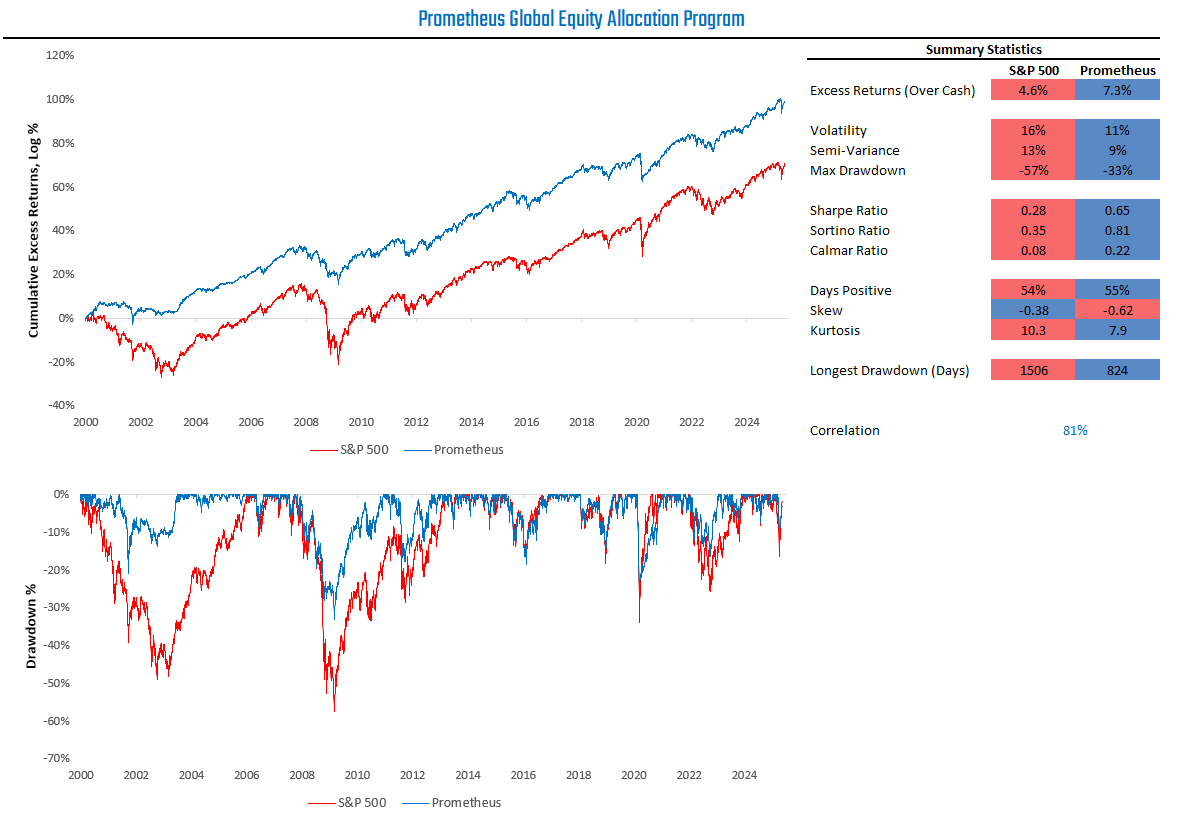

As always, to assess the value of our assessment, we simulated our approach through history, creating a portfolio that tilts between US and global assets based on these dynamics. We find that applying this understanding to an international equity portfolio creates significant improvements versus passive exposure to the S&P 500:

As shown above, a long-only, global equity allocation portfolio outperforms the S&P 500. Importantly, it maintains exposure to the S&P 500 over the long term and offers better return and risk characteristics.

We share the current allocations of this program below: