This week’s economic data painted a picture of slowing momentum without outright contraction. Across housing, construction, and labor markets, we continue to see signs of softness—but not enough to expect a recession. Meanwhile, equities showed some weakness, while gold continued its historic run.

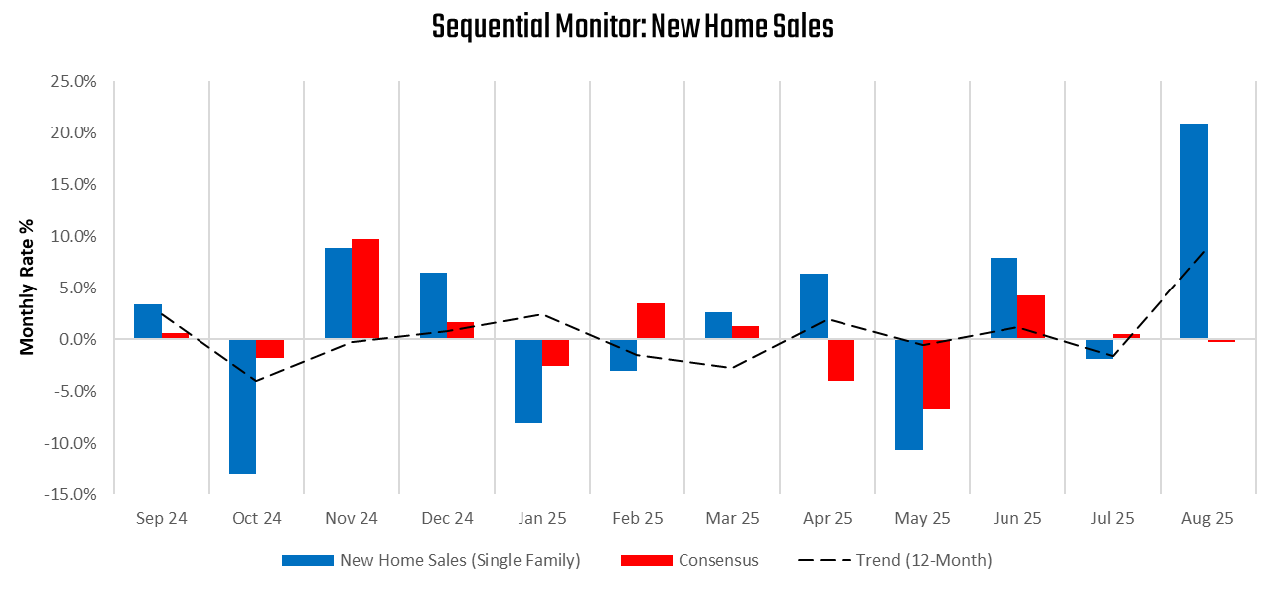

New home sales surprised to the upside, growing 20.9% versus expectations of a small decline. The strength was concentrated in completed units, while inventories remain elevated at 7.4 months’ supply, suggesting reversion pressures as sales run ahead of permits and starts:

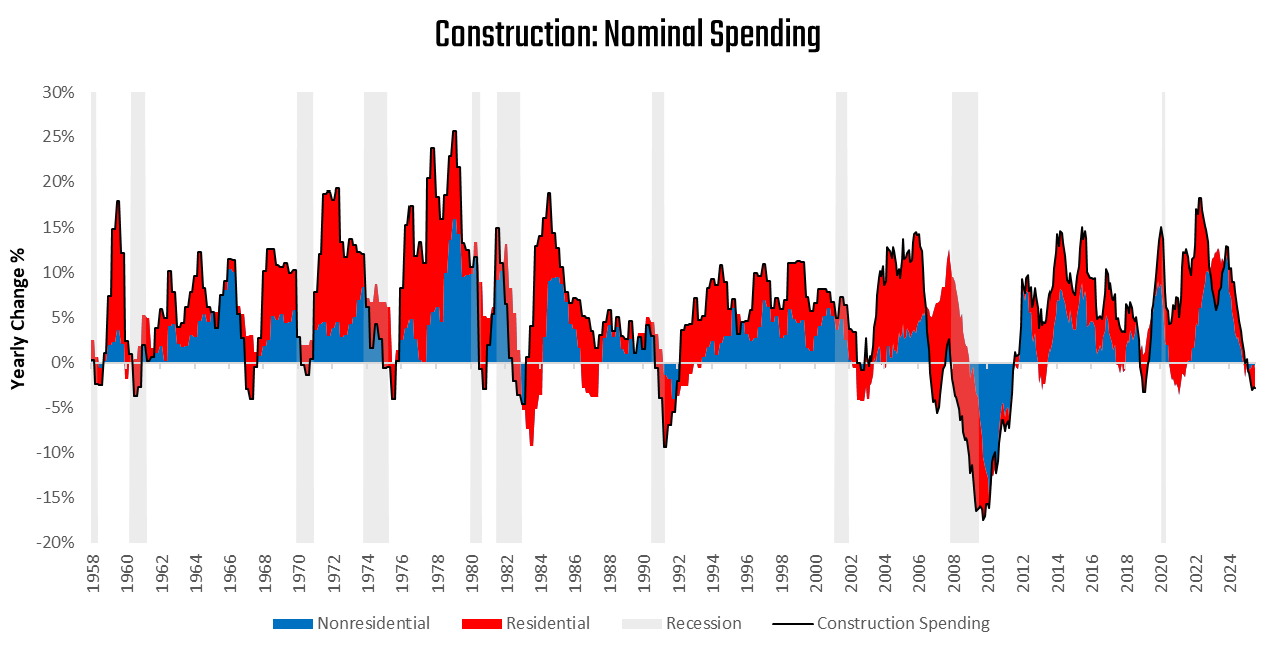

Construction data confirmed deterioration across both residential and nonresidential categories. Spending has contracted by nearly 3% year-over-year, with particular weakness in residential, manufacturing, and commercial activity. In prior cycles, this level of weakness might have tipped the economy into recession, though today’s resilience is higher:

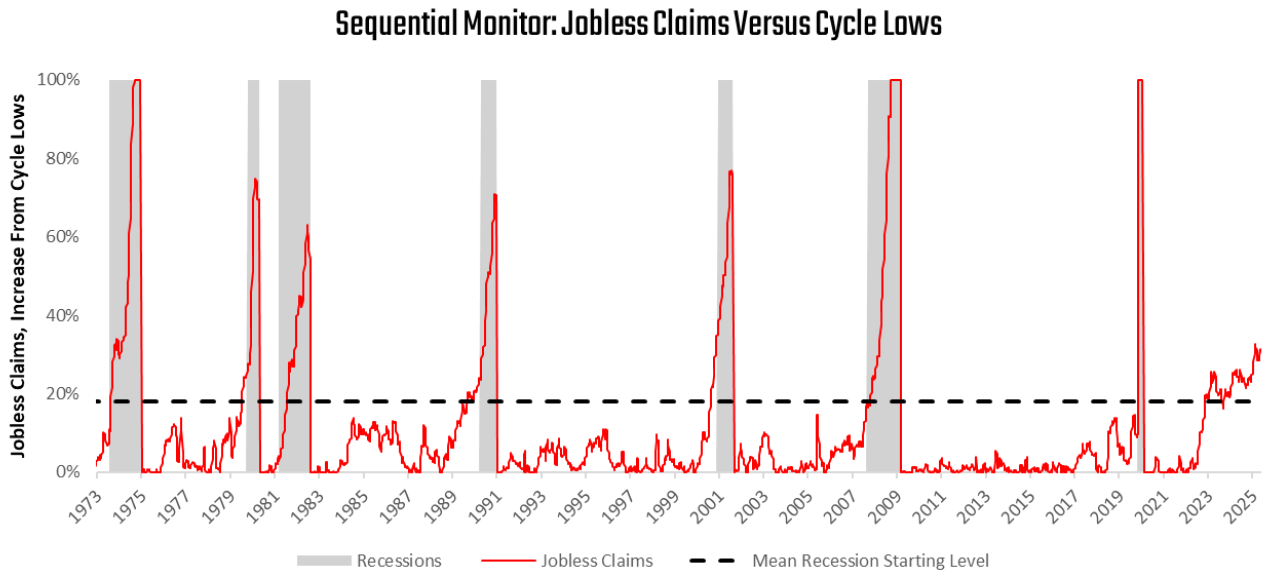

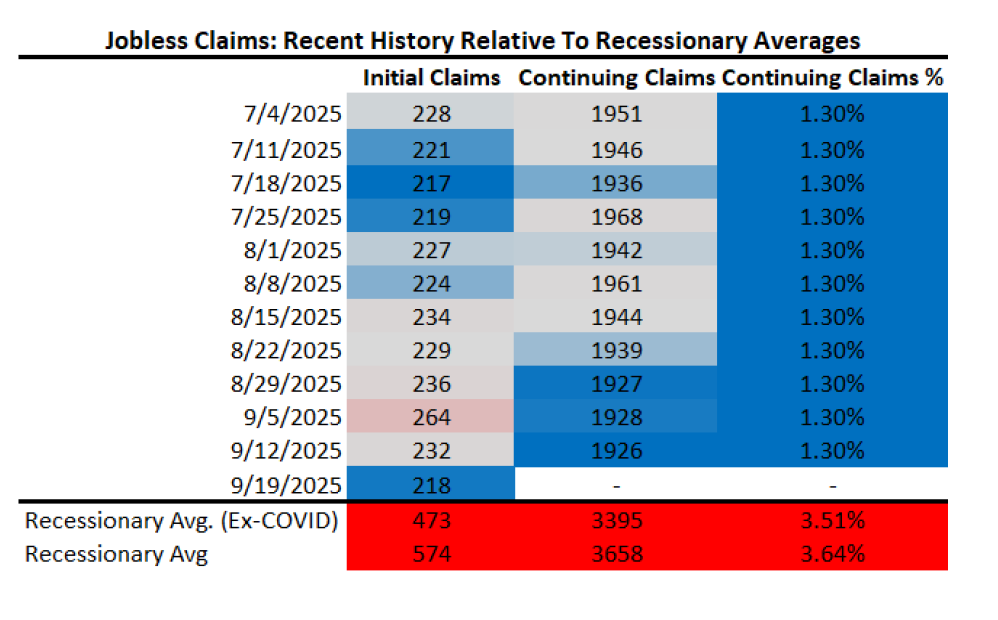

Labor markets showed more nuance. Initial and continuing claims disappointed slightly but remain well below recessionary thresholds. Our sequential monitor shows jobless claims up about 31% from cycle lows, compared to the ~18% increase that typically marks the onset of recession.

But they remain far from recessionary levels:

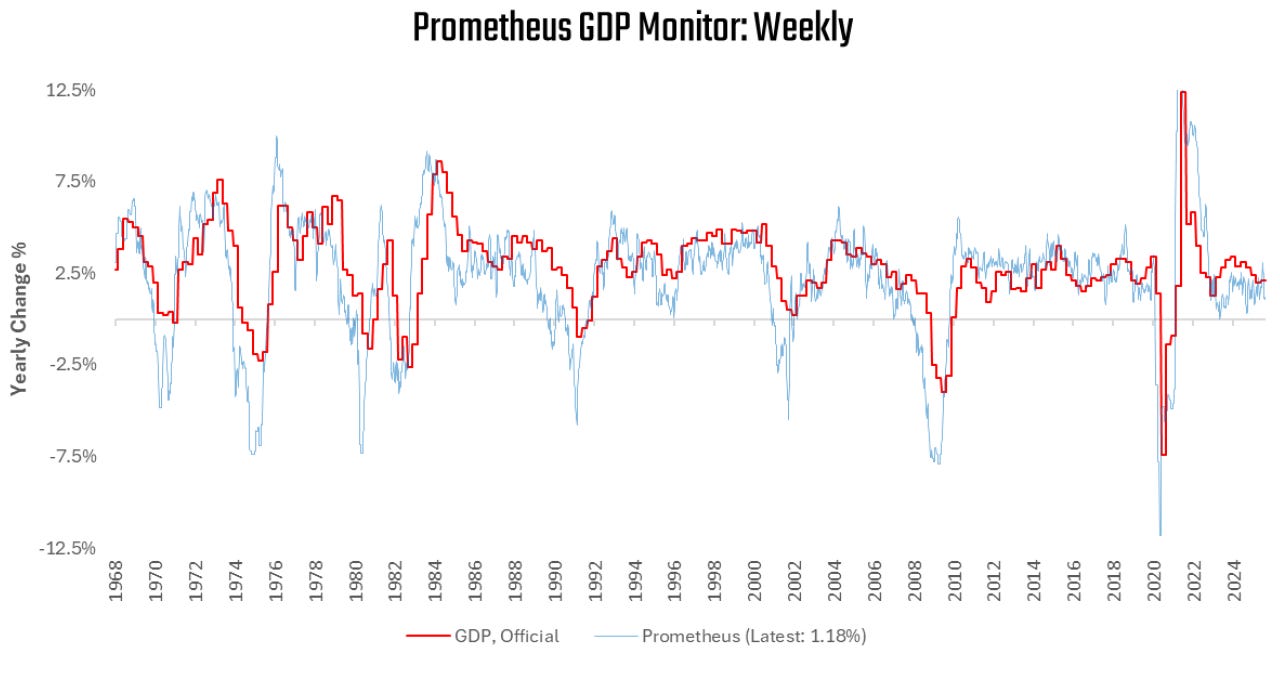

As such, our weekly GDP monitor reinforces the theme: growth is decelerating rather than collapsing. This highlights a softening economy, but one that remains resilient to sharper shocks for now.

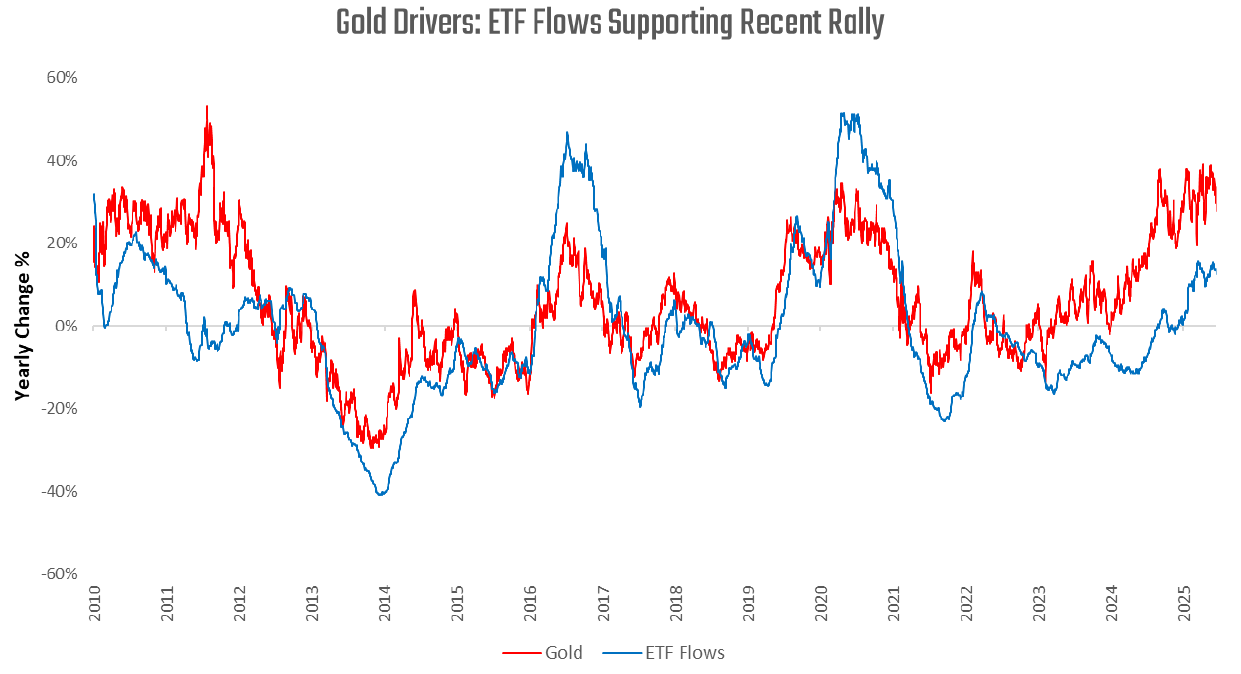

Amidst these more mixed growth conditions, gold continues to rise, driven by ETF flows:

Amidst this backdrop, the Prometheus Multi-Strategy Program entered the week with a clear pro-cyclical stance and adjusted exposures in line with evolving signals. Equity risk was trimmed modestly, though programs such as Russell and Homebuilders remained long. Sector Dispersion continued to prefer technology and industrials over energy and builders. In fixed income, shorts in Treasuries were expanded while maintaining significant relative-value longs in Bunds, BTPs, OATs, and Aussies against JGBs, Gilts, and Canadas. TIPS stayed attractive relative to nominals, anchoring the inflation-linked sleeve. Commodity positioning remained long industrials, with gold still held strategically even as the risk of reversal increased. Volatility signals offered no opportunity, leaving the portfolio positioned long equities and commodities against short bonds, consistent with the underlying macro cycle.

The future is dynamic, and our systems will adapt as the data evolves. We will keep you updated as the outlook shifts. Until next time.

Nice to get this colour on why we're decelerating but not going recessionary.