This note is one typcially reserved for clients of Prometheus Institutional. Occasionally, we make these notes available to augment our offering on Substack.

If you are a professional investor interested in access to our institutional work or want a copy of this note, email us at info@prometheus-research.com.

In this note, we share a brief overview of our Dynamic Equity program. You can find the full note below:

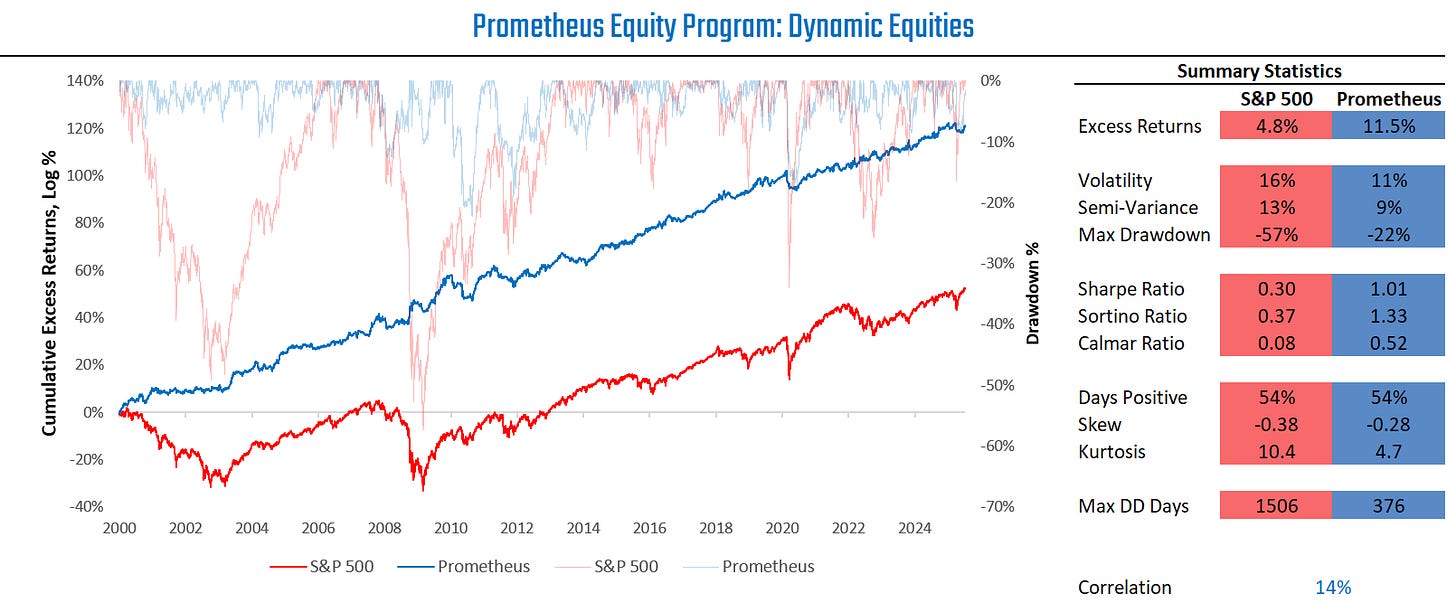

There are two primary ways to generate returns independent of beta: by harnessing relative value opportunities or through market timing. Both these approaches can offer significant benefits versus passive beta. In addition to being durable approaches to generating alpha, they also provide diversification properties to one another. The Prometheus Equity Program seeks to leverage these mechanical relationships to create a balanced but dynamic exposure to cross-sectional and directional opportunities in equity markets across US equity sectors and global equity indexes. We show the summary sheet below for this program:

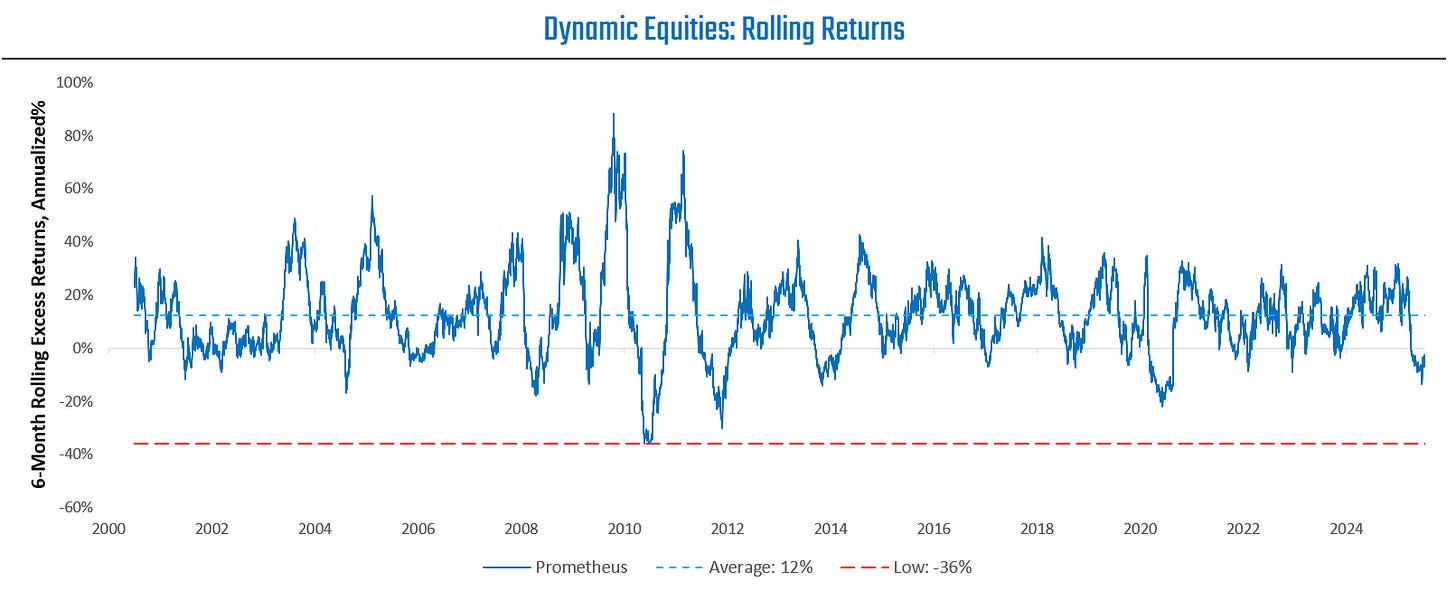

And the rolling performance statistics to evaluate return consistency:

We discuss the portfolio construction process in the next section.

The Prometheus Dynamic equity programs seek to invest dynamically in both cross-sectional and directional market opportunities. While we do not offer the specifics of our underlying signal construction, we describe the two major categories of signals that drive the program:

Relative-Value: The programs use fundamental measures of earnings, value, carry, and macro fundamentals to assess the relative attractiveness of securities, creating cross-sectional signals.

Market-Timing: The programs will also use measures of macro trend and mean reversion to generate directional signals.

Our dynamic equity programs aggregate the signals from these two sleeves to create portfolio views. This combination of relative value and market-timing signals allows our programs to choose to move exposures towards the most attractive opportunities. When there is a high degree of inter-market dispersion, our programs will favor a long/short stance. When macro conditions lead to large opportunities in beta via trend following or mean reversion, the programs will trade more directionally.

When it comes to position sizing, we’ve made a concerted effort to have all our signals in our Prometheus Institutional programs be directly proportional to their conviction. As such, all positions are sized in proportion to their signal strength. The only risk control that is applied to these positions is a 15% maximum volatility cap for each individual line item. Finally, gross portfolio exposures are leveraged 2X to achieve risk that is comparable to equity risk over time. We do not adjust or constrain risk beyond these measures. While it is suboptimal not to have risk control at the portfolio level, it is more beneficial to clients to receive raw portfolios and then manage their risk budget based on their appropriate circumstances, as this eliminates the path dependency from interfering with gross portfolio risk.

This process is applied to two distinct equity universes:

US Equity Sectors: Information Technology, Healthcare, Consumer Discretionary, Telecommunications, Financial Services, Industrials, Consumer Staples, Utilities, Homebuilders, & Energy.

Global Equities: United States, United Kingdom, Japan, Canada, China, Italy, France, Germany, India, & Australia.

Our Dynamic Equity program allocates these two strategies equally, treating them as an independent portfolio. These two sub-portfolios are available independently as part of the Prometheus Institutional Multistrategy Program. Please feel free to reach out to us if you’re an institutional investor and this program aligns with your investment mandate.

Until next time.

Looks great Aahan. Congratulations on launching this. Hoping some of the global equity strategy works itself into the retail offering somehow, even if by proxy, which I understood is already a signal for the S&P program.