We scan through the latest construction data and what it means for the Prometheus Multi-Strategy Program.

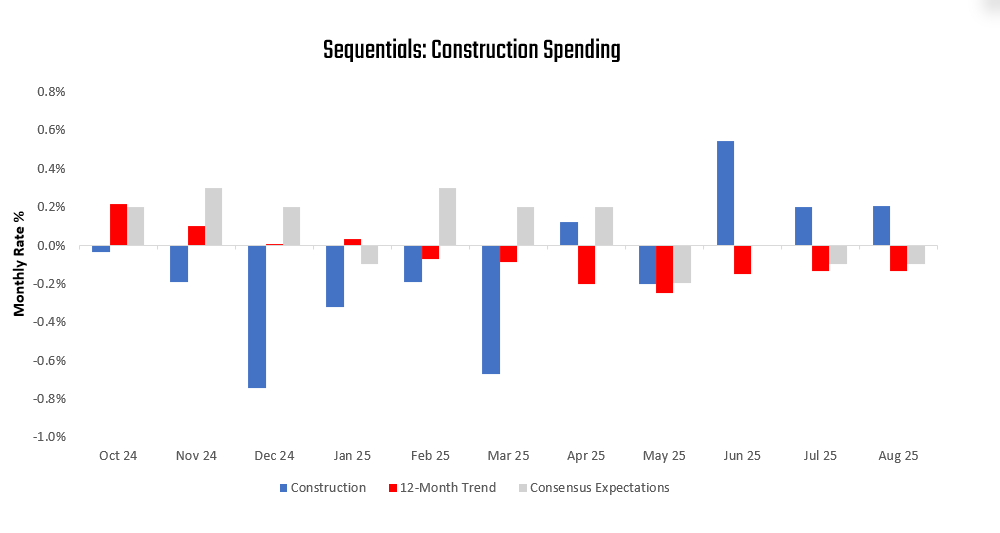

The most recent data for August show that construction spending increased by 0.21%, with contributions of 0.34% and -0.13% from residential and nonresidential spending, respectively. This data surprised consensus expectations of -0.1% and contributed to a deceleration in the twelve-month trend.

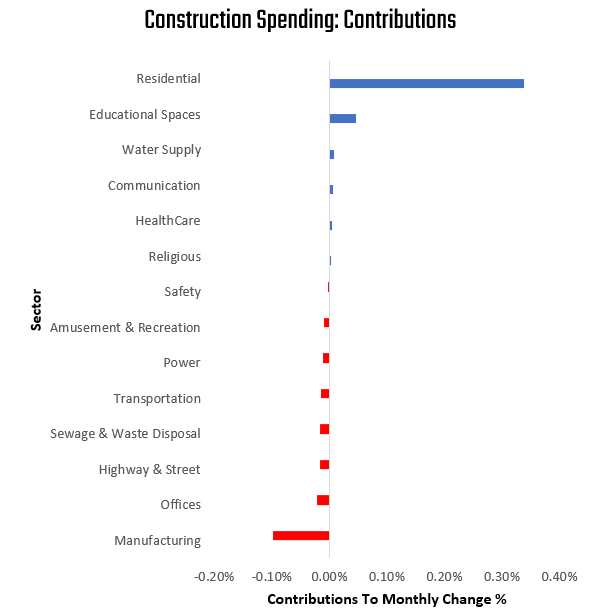

For further context, we show the composition of the most significant change in monthly construction spending. The strongest contributor to construction spending in August was Sewage & Waste Disposal, while the weakest was Residential in construction spending:

Zooming out, we show the evolution of construction spending over the last year, which fell by -1.63%%. This was driven by a -0.89% decrease in residential spending and a -0.74% fall in nonresidential spending. Below, we drill down further to show the top 3 drivers of strength in blue (Sewage & Waste Disposal, Transportation, and Power) and the top 3 drivers of weakness in red (Manufacturing, Residential, and Commercial):

These weak trends continue to add weight to the evidence that housing remains under pressure, despite a positive sequential print. Housing activity ahead continues to look weak as well:

Furthermore, scanning through the construction data, we find that the construction of manufacturing facilities continues to decline as well.

The combination of these dynamics suggests weakness in residential and manufacturing investment. The Prometheus Multi-Strategy Program has been expressing these views through short exposures to the Russell 2000 and US Homebuilder indices. Those remain in play:

Until next time.

thanks for the analysis on construction. where would data center construction show up, and how has that been faring? if DC construction is to slow down, a real slowdown will likely be under way?

"change in monthly construction spending. The strongest contributor to construction spending in August was Sewage & Waste Disposal, while the weakest was Residential in construction spending"

This confuses me. The graph below this text shows the exact opposite