Quick highlights from the latest CPI data. A more detailed note including these system outputs will be released next week, when the team returns from vacation.

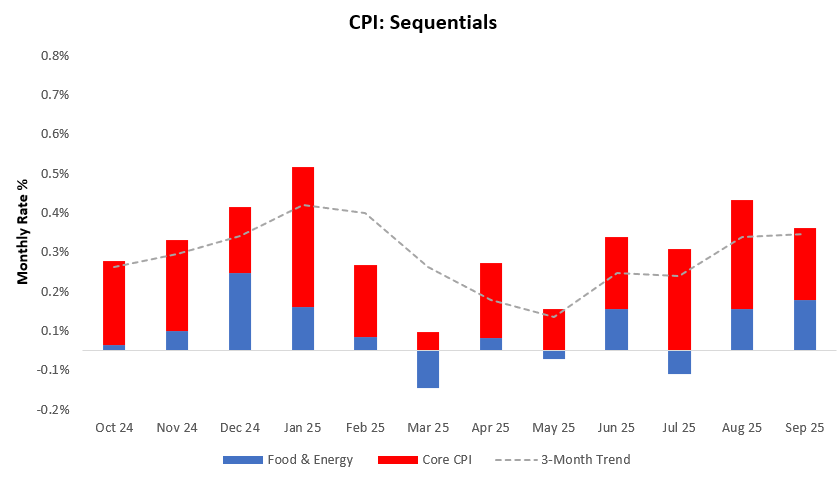

In September, headline CPI came in at 0.31% disappointing consensus expectations of 0.4%. Core CPI contributed 0.18% to this print, with food & energy contributing the remaining 0.13%. This print drove an acceleration in the three-month trend. Below, we display the sequential evolution of the data:

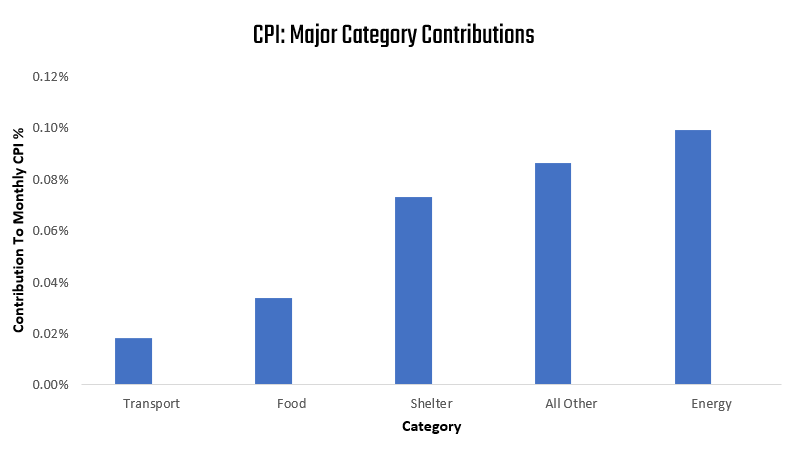

The primary drivers of CPI inflation are food, energy, transport, and shelter. These components have contributed 0.03% (Food), 0.1% (Energy), 0.02% (Transport), and 0.07% (Shelter), respectively. We display these contributions to the 0.31% change in CPI below:

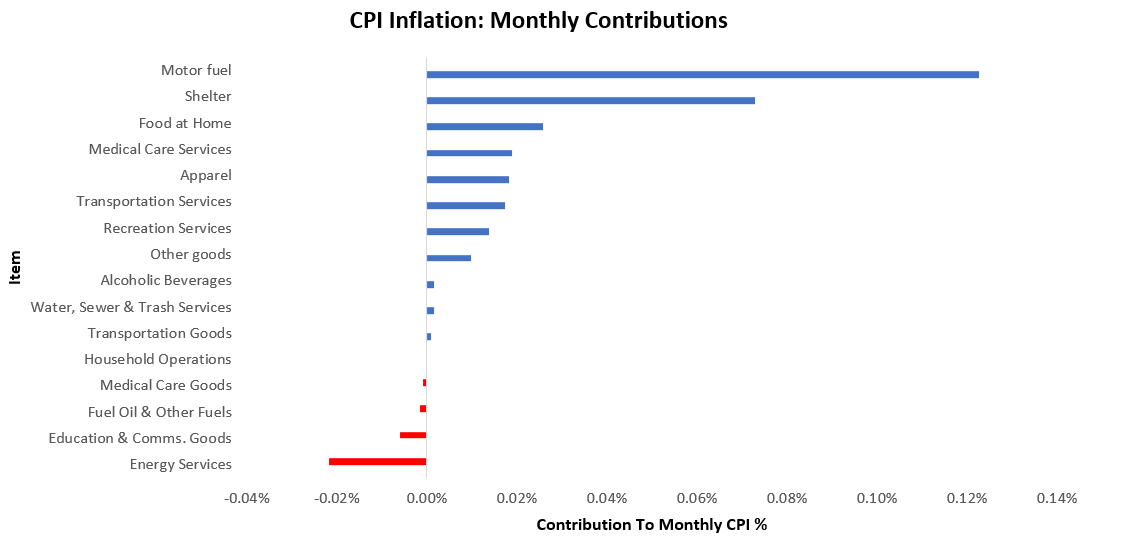

Inflation was largely positive, with Motor fuel contributing most positively, and Energy Services contributing most to weakness. We display the largest movers to the upside and downside below:

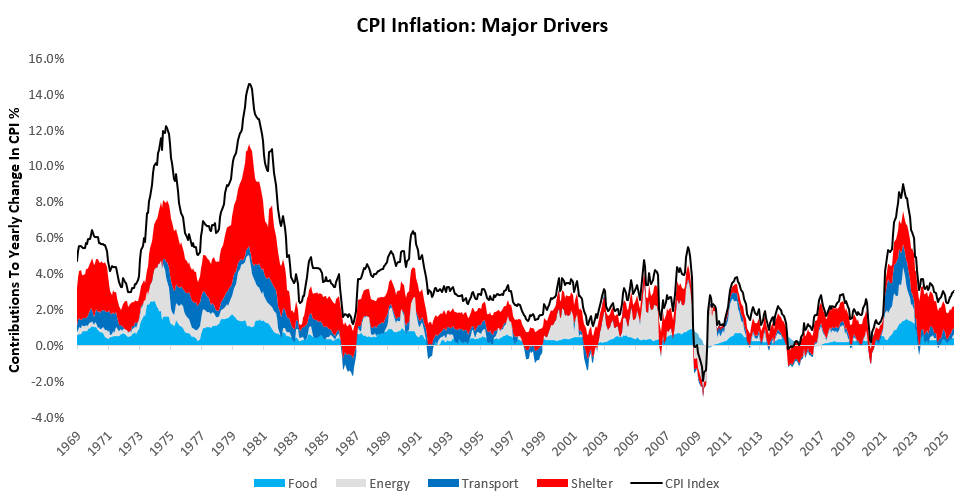

For further perspective, we show how these areas have accounted for the majority of variation in inflation both economically and statistically. Over the last year, food, energy, transport, and housing have contributed 0.42% (Food), 0.2% (Energy), 0.32% (Transport), and 1.26% (Shelter), respectively, to the change in inflation. We display these principal drivers of inflation over time below:

Inflation remains above the Fed’s target. Energy remains a significant contributor to overall inflation here. If the energy in transit and inventory overhangs begin to weigh on energy prices, this will create a better inflation backdrop—but that remains to be seen. For now, we stay in an uncomfortable spot for the Fed —and, in turn, the bond market.

Disappointing? Weird verb choice for less inflation than expected. Are you rooting for more inflation?

"In September, headline CPI came in at 0.31% disappointing consensus expectations of 0.4%."

Did you mean? "In September, headline CPI came in at 0.31%, below consensus expectations of 0.4%." Or are you still disappointed?