Oil prices have risen dramatically over the last few weeks as the US conducted its raid on Venezuela and threatened to take military action against Iran. However, our systematic process continues to point to pressures on the oil complex. We take a step back to examine the macro drivers of energy and chart a course for the future.

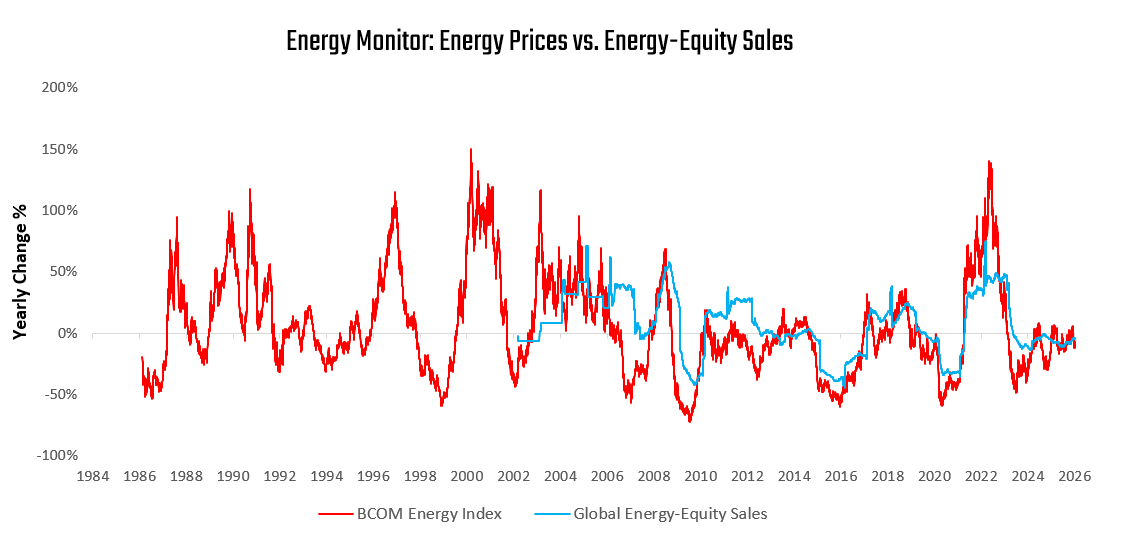

Energy prices primarily reflect demand conditions coming from the global economic cycle relative to existing production. Demand conditions, based on global energy producer sales, continue to remain tepid:

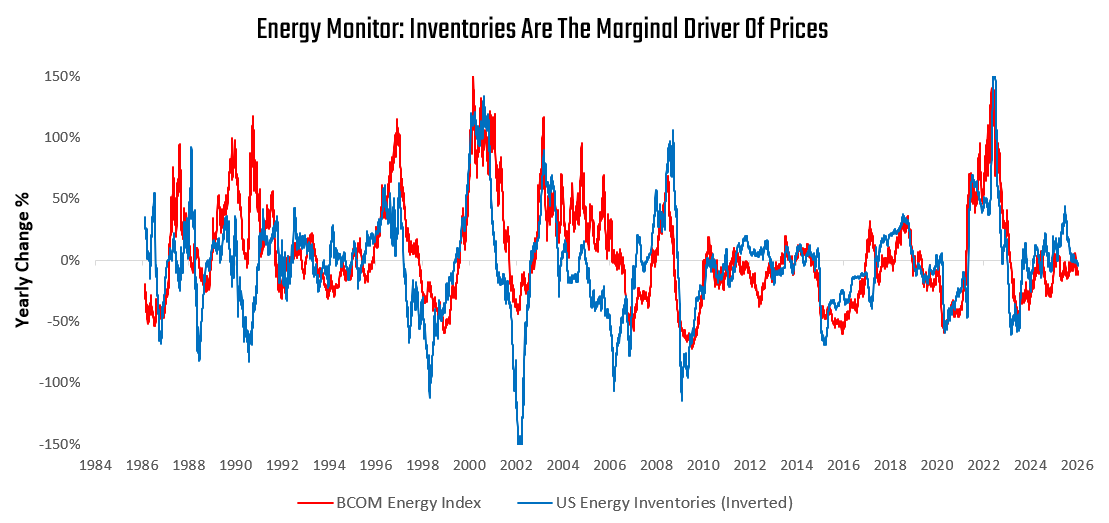

While energy demand remains modest, energy inventories continue to show neutral conditions as well:

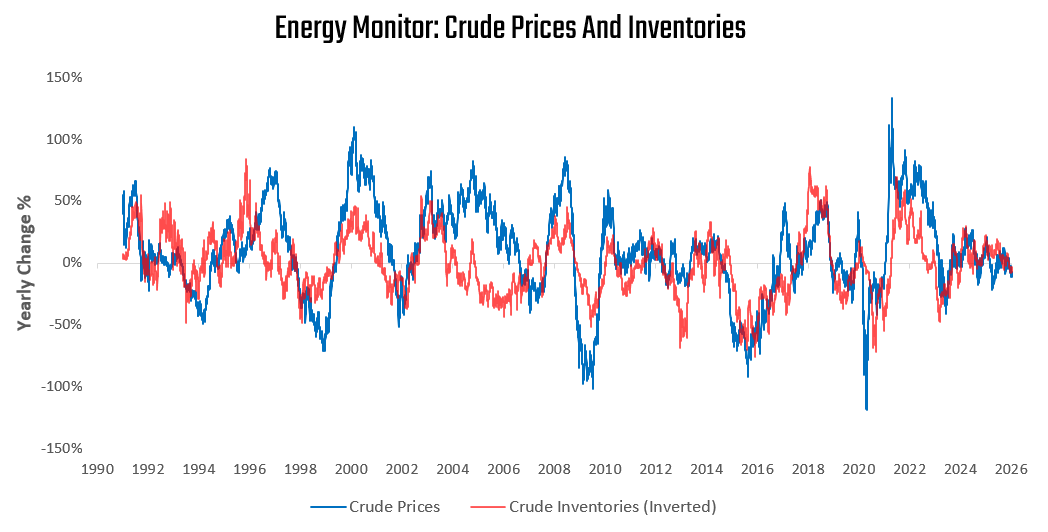

Energy inventories continue to confirm a weak backdrop for energy price trends. We zoom into the crude complex as the central market of the oil complex. Much like the broader energy complex, we continue to see weak price trends confirmed by neutral/higher inventories:

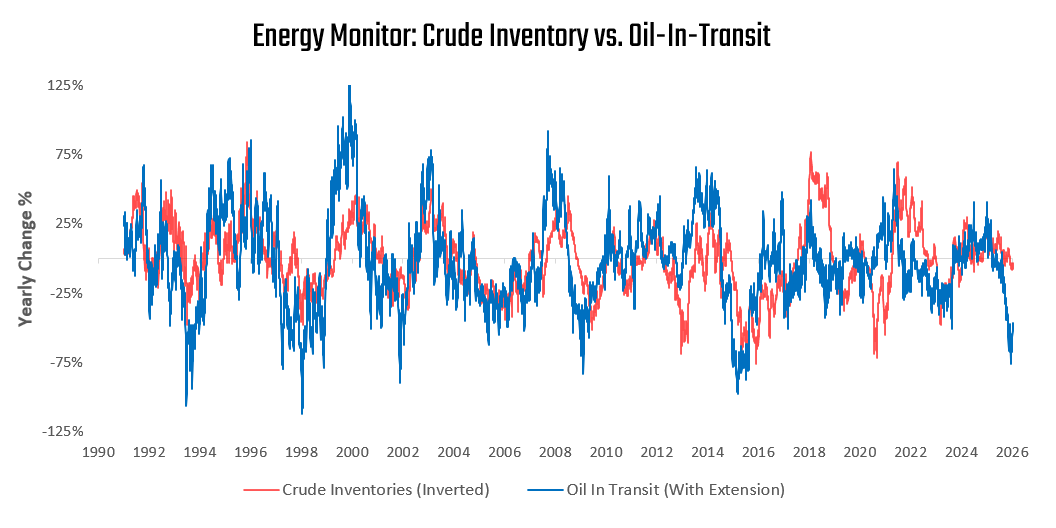

While medium-term price trends and current inventories continue to suggest a much more benign outlook for crude than recent price trends imply, future inventories likely point to a much more negative outlook. Below, we show how global oil in transit suggests meaningful increases in inventories ahead:

With global demand conditions neutral, current supply conditions modestly negative, and prospective supply conditions materially negative, there remains little cyclical support for recent crude price trends.

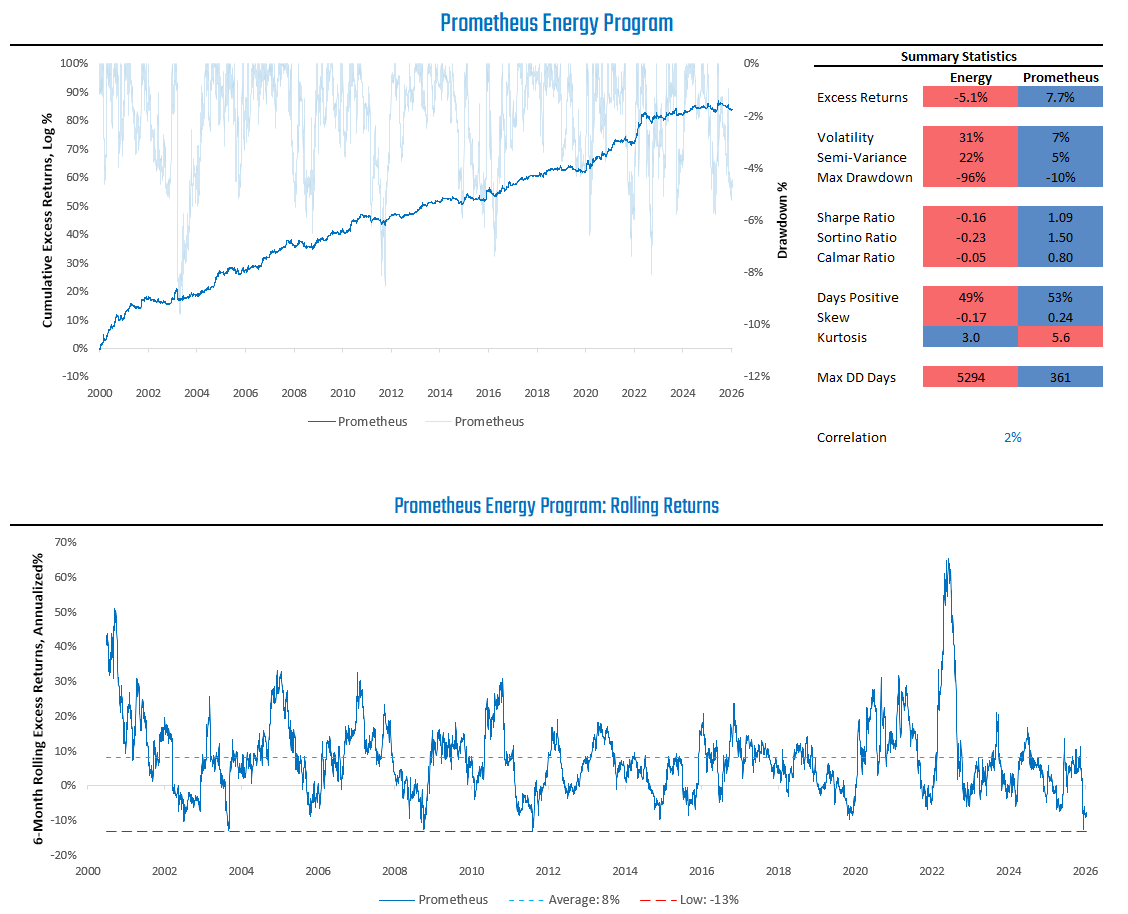

In this backdrop, we expect the Prometheus Energy Program to prove adept at navigating these energy cross-currents using our mix of fundamental and price-based measures:

The future is dynamic, and our systems will adapt as the data evolves. We will keep you updated as the outlook shifts. Until next time.