Can Stocks Continue To Outperform?

The Observatory

Welcome to The Observatory. The Observatory is how we at Prometheus monitor the evolution of the economy and financial markets in real-time. The insights provided here are slivers of our research process that are integrated algorithmically into our systems to create rules-based portfolios.

This note is one typically reserved for clients of Prometheus Institutional. Occasionally, we share notes from our Prometheus Institutional to augment our retail offering here on Substack. If you’re interested in access to our institutional work, you can click this link:

Or just email us at info@prometheus-research.com.

Today, we examine the status of the most business cycle-sensitive areas of the economy to understand the prospective trend in corporate profits relative to what’s priced in. Business cycles are a function of cyclical revenues, profits, and employment fluctuations. Archetypically, some areas of the economy are more exposed to these cyclical fluctuations. These sectors experience far more cyclical NGDP than other segments of the economy, and tracking their evolution allows for a broader and more granular understanding of business cycle conditions. Our observations after assessing these areas are as follows:

Cyclical sectors are showing muted nominal activity, which will likely translate into muted corporate profitability.

In particular, the real estate and industrial sectors are showing weakness, while transportation has accelerated.

Markets are pricing in a significantly rising earnings backdrop relative to these fundamentals, potentiating earnings disappointments.

Applying this understanding systematically can help us determine whether stock markets will likely experience above-average returns or below. Today, this understanding suggests that equity markets are likely to experience a regime of underperformance relative to their historical mean.

Let's dive into the data and systems driving these observations. We begin by visualizing how cyclical real spending drives business cycles. Below, we show the contribution of cyclical activity to real GDP. It is crucial to note that almost all business cycle variation comes from cyclical activity, as visualized below:

As per the latest official data, cyclical real GDP is expanding modestly relative to real GDP growth and has been decelerating in recent months.

It is clear that cyclical activity is an integral part of the business cycle. To evaluate the business cycle pressures emanating from these segments of the economy, we examine the nominal GDP that a variety of these cyclical sectors are experiencing in a manner consistent with their contributions to NGDP.

We begin with real estate. Real estate is one of the dominant drivers of the business cycle, with equal contributions from the residential and non-residential components:

As per our latest estimates, real estate is in a decelerating contraction, as shown above.

Next, we turn to nominal spending on furniture and building materials. The demand for these items is closely tied to the residential real estate cycle:

As shown above, our estimates place Furniture & Building Materials in a decelerating expansion.

To gain further insight into the status of the housing cycle, we turn to household spending on durable goods such as appliances, electronics, and kitchenware. This helps us understand the status of the consumer, though it is only modestly sensitive to credit conditions.

As per our latest estimates, household products are experiencing an accelerating expansion. In summary, while housing has begun to turn downward, the multiplier effects are yet to be seen as we are still in a nascent downturn.

We now turn back to the leverage-sensitive components of the economy, particularly motor vehicles. Like real estate, motor vehicle demand is a key barometer of business cycle conditions.

Today, Cars & Trucks is in an accelerating expansion and has continued to expand. Motor vehicle retailers are seeking to rebuild inventories in the post-pandemic world.

While motor vehicle demand partially indicates consumer demand, it also serves as a barometer of manufacturing conditions. We turn to nominal spending on industrial equipment for further insight into industrial conditions. Industrial equipment investment is a key part of manufacturing and aggregate investment spending.

Per our latest estimates, industrial equipment is experiencing a decelerating contraction and is unlikely to exit its downward spiral.

Next, we turn to the most volatile component of cyclical growth conditions: inventories. Inventories are an extremely cyclical component of business investment, with a higher degree of sensitivity to the ongoing pace of business sales.

According to our estimates, inventories are currently experiencing a decelerating expansion.

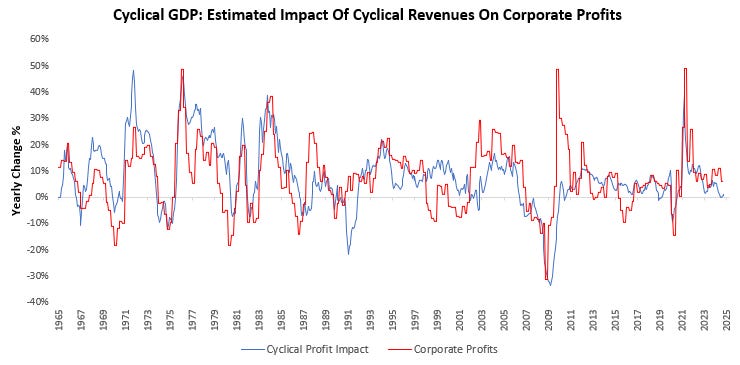

Finally, we aggregate NGDP spending across a range of cyclically sensitive sectors and reconcile their impact on corporate revenues to estimate the effect of cyclical revenues on corporate profits. As we visualize, cyclical revenues account for most of the variance in big cyclical swings in corporate profits.

Based on our comprehensive analysis of pressures emanating from cyclically sensitive areas of the economy, our gauges suggest downward business cycle pressures on corporate profitability.

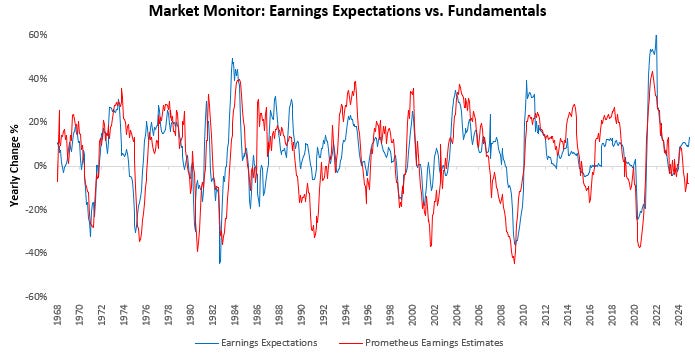

This pressure contrasts with current earnings expectations. To visualize this dynamic, we show our fundamental earnings gauges, which aggregate the above insights to create leading earnings growth estimates and compare these to changes in earnings expectations.

As shown above, our measures show potential weakness in earnings while earnings expectations have continued to rise. This divergence creates a weak backdrop for equity markets.

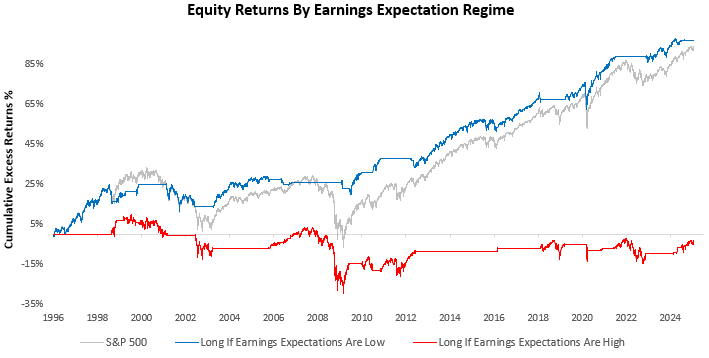

We can quantify this weakness using our systematic tools. To illustrate how these dynamics impact equity markets, we take measures of earnings mispricing and create two simple, long-only trading strategies to trade the S&P 500. The first goes long, the S&P 500, when earnings expectations are mispriced too low, and the second goes long when mispriced too high. We compare both versus the S&P 500 below:

As shown above, equities outperform when earnings expectations are mispriced to the downside and underperform when expectations are too high. Buying stocks when earnings expectations are low results in a Sharpe Ratio of 0.70, as compared to buy and hold of 0.40. Owning stocks when earnings expectations are high results in a relatively meager Sharpe Ratio of 0.06. Today, our gauges suggest earnings expectations are too high, and as such, we expect equity returns to be much more modest.

While this does indeed imply lower equity returns at the index level, these dynamics are not evenly distributed between sectors. Some sectors continue to experience strong nominal spending, particularly those at the intersection of consumer demand and intellectual property investment. We show how intellectual property spending remains resilient to any business cycle slowing:

We have similar dynamics in healthcare, utilities, and consumption spending. While this resilience blunts the impact of the typical recession process, it also creates relative value opportunities to trade equities.

To harness these opportunities, we have been developing our equity sector rotation programs:

Currently, this strategy is biased toward industrials and technology and discretionary toward energy, materials, and real estate.

Overall, the economy is slowing, but earnings expectations are inconsistent with the slowing. This will likely weigh on index returns and adversely impact certain sectors more than others.

If you’re interested in this strategy or the rest of our institutional research suite, which powers these insights, contact us using the link below.

If you’re not an institutional investor but would like to leverage our process via our long-only ETF Portfolio, you can check them out here:

Until next time.

Thanks for sharing!