This note is one typically reserved for clients of Prometheus Institutional. Occasionally, we share notes from our Prometheus Institutional to augment our offering here on Substack. If you are interested in access to our institutional work, you can click this link:

Or email us at info@prometheus-research.com.

Over the last quarter, US treasuries have continued to face cross-currents from macro conditions.

We take stock of these factors to assess the outlook for bonds:

Bonds continue to face structural headwinds in the form of limited monetary policy pass-through and resilient inflation versus the Fed’s target.

Nonetheless, changes in financial conditions and their prospective impacts on economic activity are cyclical support for bonds.

The combination of these dynamics makes treasuries attractive in the US context as a ballast for investor portfolios, but much less attractive relative to global bonds, particularly those in Europe.

Let’s dive into the data driving this assessment.

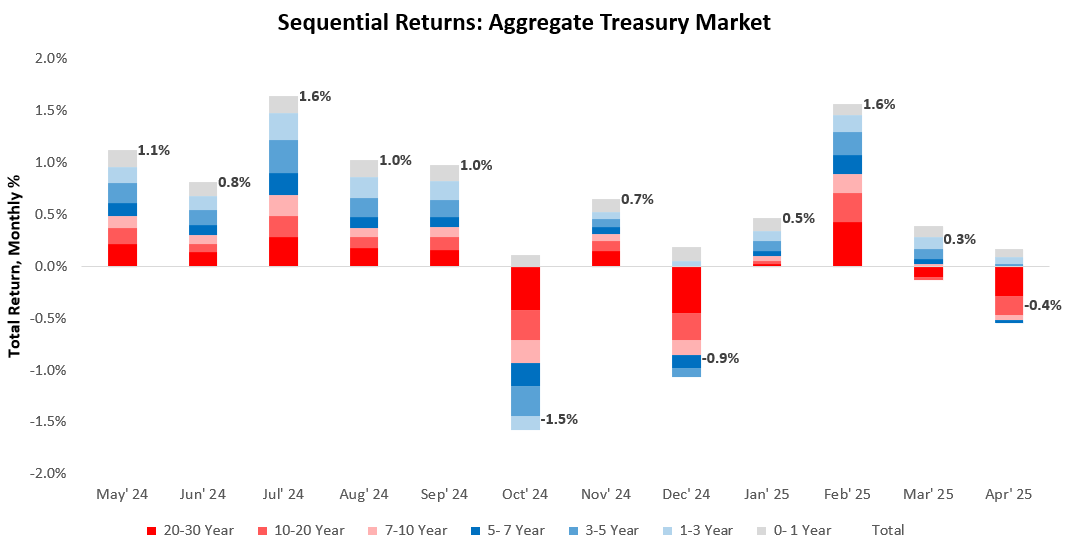

We begin with recent price dynamics. Over April, treasury markets fell by -0.37%. Over the last year, our aggregate treasury markets have returned 5.9%. Below, we show the sequential evolution of returns:

For a more granular understanding of the returns from the most recent months, we perform an attribution of total returns from various maturities of nominal treasuries across the yield curve. Over April, treasury markets were somewhat mixed, with 0- 1 Year treasuries contributing the most to strength, while 20-30 Year treasuries contributed the most to weakness. We show this below:

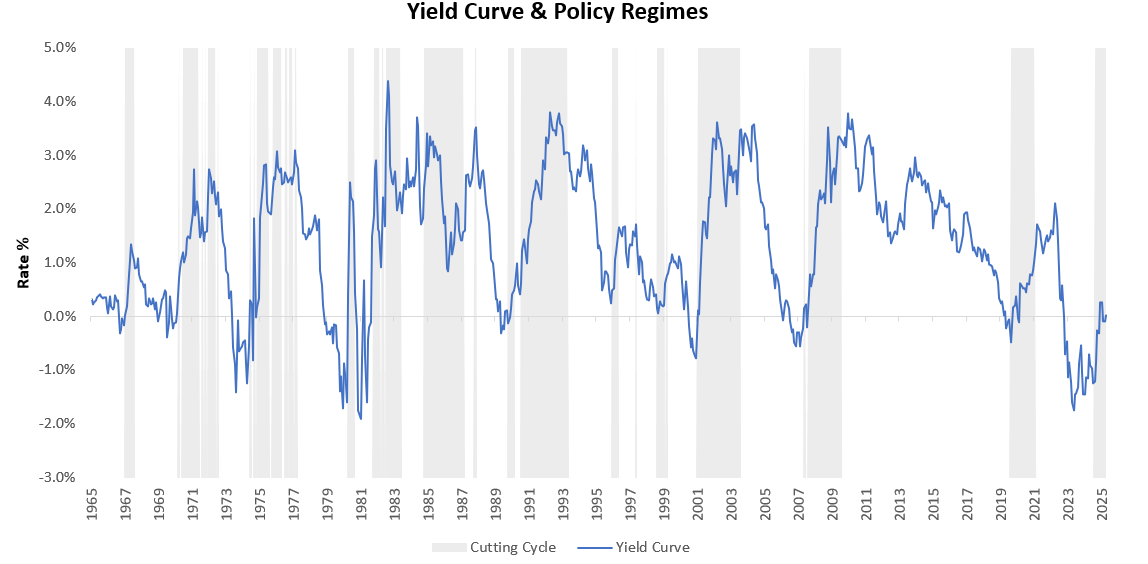

These relative price dynamics resulted in a steepening of the yield curve.

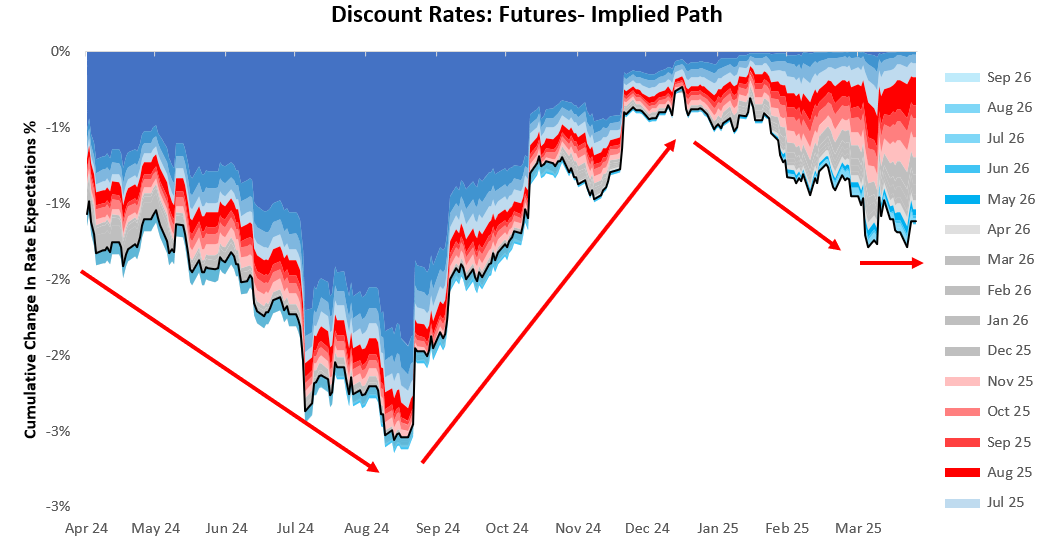

These yield curve dynamics reflect a flattening of the expectations of future policy cuts. Over the last month, short-term interest rate markets have remained unchanged. We show the evolution of these expectations below:

To better contextualize these recent changes in policy expectations, we show the latest discount rate path priced over the next eighteen months. Short-term interest rate markets are expecting a peak in policy rates on May 25 at 4.33%, followed by a trough on Jul 26 at 3.19%. This implies approximately four interest rate cuts cumulatively over the next eighteen months. We show this path below:

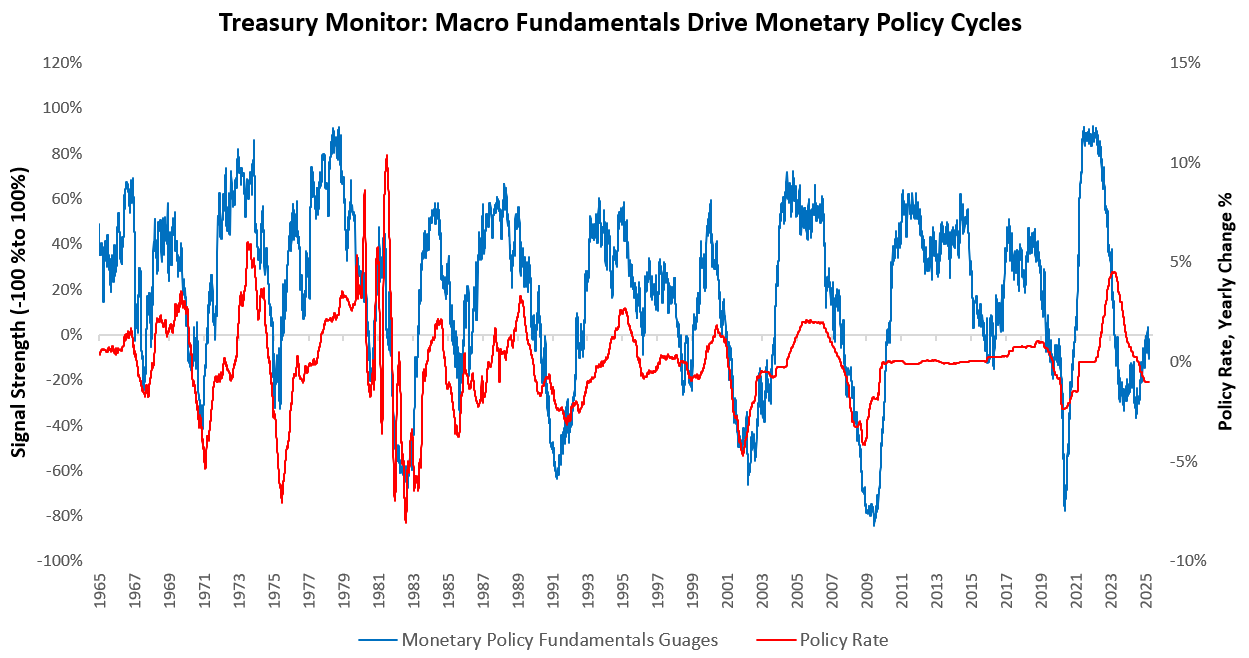

This flattening of policy expectations is mainly consistent with the lack of impetus for the Federal Reserve to move policy rates based on recent employment and inflation data. We see this in our Monetary Policy Fundamentals Gauge, which aggregates data across growth and inflation measures to understand the forward-looking pressure on monetary policy:

As shown above, our monetary policy gauge indicates a low potential for a meaningful easing cycle based on fundamental macroeconomic data.

Nonetheless,