This note is one typically reserved for clients of Prometheus Institutional. Occasionally, we share notes from our Prometheus Institutional to augment our retail offering here on Substack. If you are interested in access to our institutional work, you can click this link:

Or email us at info@prometheus-research.com.

Over the last four weeks, equity markets have experienced a significant step up in volatility, with stocks selling off while bonds catch a firm bid. These price movements have mirrored traditional risk-off dynamics, consistent with those during business cycle downturns and recessions. The question on investors’ minds today is whether this nascent macro-market trend can become a full-fledged bear market. We leverage our systematic macro process to identify the levers and understand the likely path forward.

Our observations are as follows:

Equities have sold off significantly, while bonds have rallied in a manner consistent with significantly weaker growth expectations.

Relative to these market developments, business cycle conditions remain positive in the aggregate, though there are some areas of weakness within this aggregate picture.

The combination of these dynamics creates a mismatch between short-term momentum and forward-looking measures of economic activity.

Systematically quantifying this picture allows us to understand whether this equity market correction can turn into a bear market. Today, equity markets remain supported by an expanding business cycle, which makes dips buyable rather than short-worthy.

Let’s dive into the data driving this assessment.

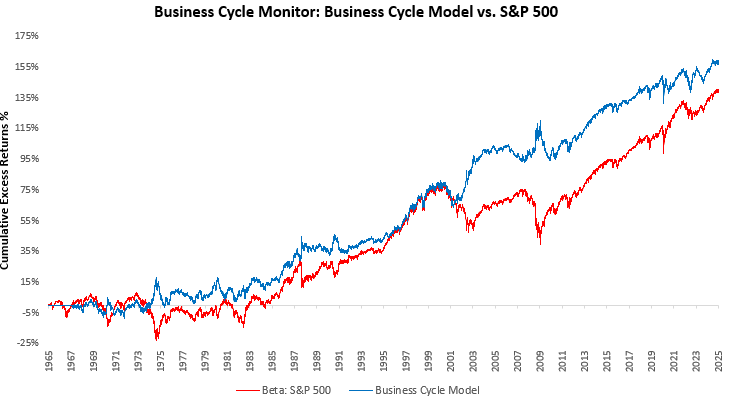

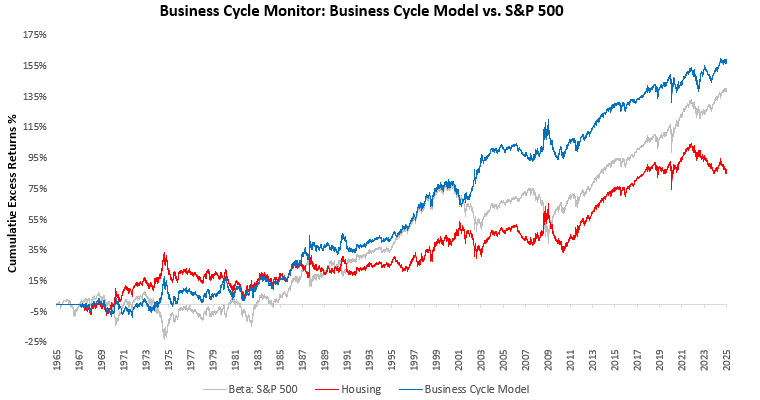

The business cycle is the cyclical variation of economic growth over time, driven by changes in business investment. These changes in business investment are a function of current and expected income, which determine output and employment. Extremes in business cycle conditions create serial correlations in the economy and markets. Extremely strong business cycle conditions result in inflation, while extreme weakness in business cycles results in recession. These extreme environments are highly influential on market trends. As such, we think a consistent, comprehensive, and timely assessment of these dynamics is key to navigating market cycles. We begin by showing how applying these assessments systematically through our Business Cycle Model can meaningfully improve or add value to equity market exposure.

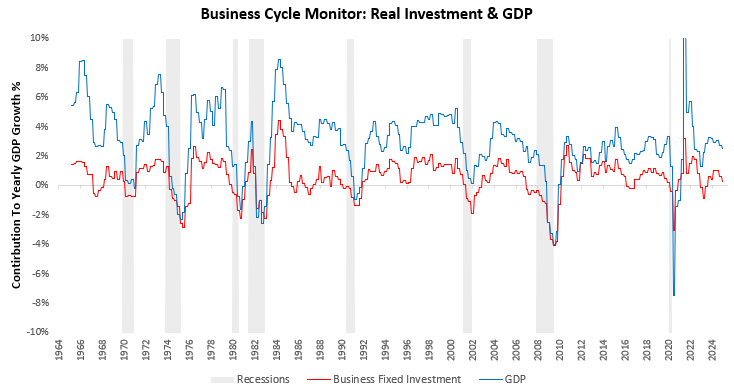

As we can see above, using our Business Cycle Model has been value-additive to equity market exposure. In this note, we evaluate the drivers of the business cycle that drive this strategy. We begin with the most important part of the business cycle: business fixed investment. Fixed investment is the dominant factor in determining whether GDP is going to experience an upswing or downturn. Further, business investment is an extremely large source of profits because it creates income that ultimately returns to businesses in aggregate. Below, we visualize how business investment defines downturns and upswings in the economy:

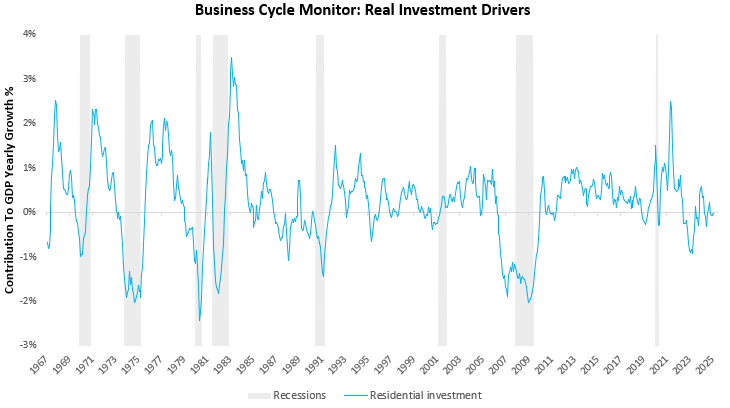

As we can see above, investment cycles play a crucial role in determining the cyclical variations of the economy, particularly on the downside. Every recession is characterized by weakness in business investment. Per the latest official data, business investment has begun to decelerate. By tracking each of the underlying components of business investment, we can get a more comprehensive understanding of the sustainability of this deceleration. There are five major components of business investment: residential, industrial, transport, information, and intellectual property. We examine each, starting with residential investment:

Residential investment has begun to decline recently, which is a meaningful sign of business cycle weakness.

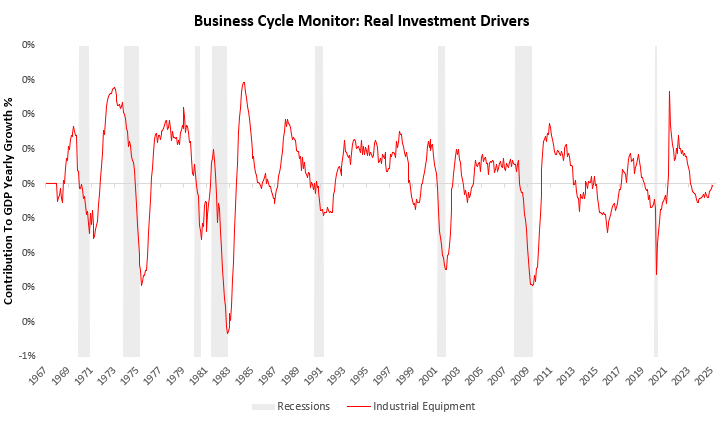

We now turn to industrial equipment investment, which gives us significant insight into the strength of the industrial sector:

Industrial equipment spending by companies has begun to bounce after a period of contraction. The industry continues to face headwinds but is sequentially improving.

Next, we turn to transportation spending, which includes both household and business investment in transportation:

Transportation spending has also begun to trend upward, much like industrial investment.

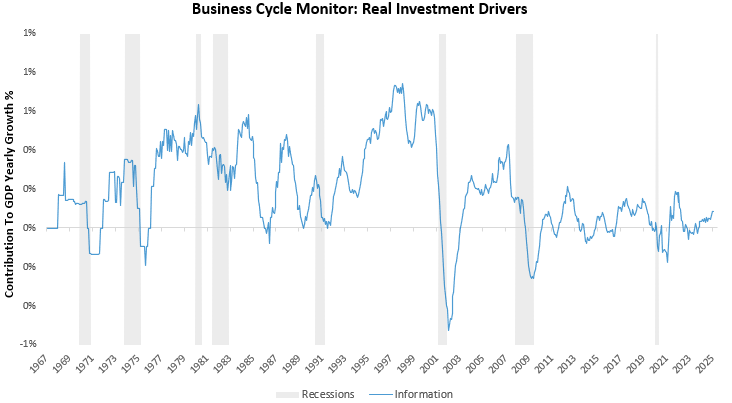

So far, we have covered the industries that have classically defined the business cycle, particularly in the pre-internet age. However, in the post-internet age, there has been an abundance of investment in the economy in the form of information equipment and intellectual property products. These areas have become crucial drivers of the business cycle. We begin by examining investment in information equipment, which includes computers, communication equipment, and related technology:

Information equipment spending has begun to accelerate further within its ongoing expansion.

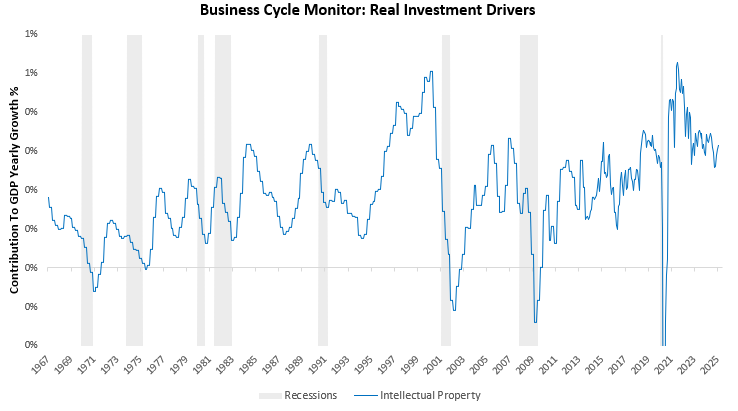

Finally, we turn to intellectual property investment. While information equipment investment showed its largest gains during the lead-up to the technology bubble only to mean-revert, intellectual property investment continues to climb in its contributions to total business investment in the modern era.

Intellectual property investment remains elevated and stable.

Overall, investment conditions are largely improving, with the notable exception of residential investment. However, at the current juncture, the declines in residential investment are not sufficient to create a downturn in aggregate investment or economic activity. The primary channel through which declining investment conditions become a self-reinforcing downturn is the labor market. To better understand the prospective pressures on the labor market, we aggregate the activity of the most capital-intensive businesses: construction, goods and industrial equipment, and information and intellectual property. We then compare these aggregated measures of activity to their respective employment trends to understand the pressures at play.

We begin with construction, comparing the trends in output growth to those of labor growth. These measures are shown as contributions to total real GDP growth and nonfarm payroll growth, respectively. This format allows us to illustrate how the GDP impact and labor impact of sectors are highly synchronized.

Construction output and employment continue to remain positive. At current levels of construction investment, there is little reason for a downturn in construction employment. This serves as significant support for total job growth.

Next, we turn to goods and equipment output. These sectors drive employment in the manufacturing and trade sectors. Once again, we present these measures as contributions to total real GDP growth and nonfarm payroll growth:

Goods and equipment output has begun to rise, while employment remains weak. This weakness in employment primarily stems from the manufacturing sector, which has been in a persistent downturn.

Finally, we examine the output and employment of the information and intellectual property sector:

Activity in this sector remains extremely strong as corporations continue to invest in expanding their intellectual property. This increase will likely continue to support the ongoing reacceleration in employment growth, which is now at neutral levels.

Overall, there remains limited weakness in these capital-intensive areas of the economy. Output in these sectors remains positive despite some weakness in manufacturing employment.

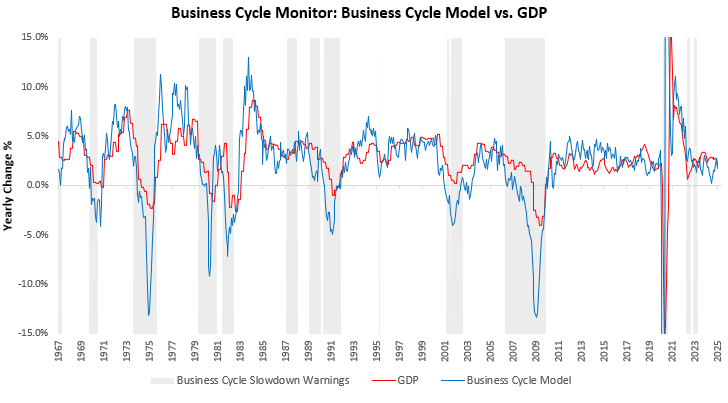

Combining the data on business investment, capital-intensive output, labor conditions, and their underlying trends, we can create a forward-looking estimate for GDP growth. The purpose of this estimate is not to be extremely precise on future GDP growth but rather to give us early indications of when we may enter into a business cycle downturn while still offering some forward-looking insight into its prospective GDP impact.

We reiterate the performance of the model compared to passive long exposure to the equity market. Additionally, we compare our approach to applying a more commonly cited leading indicator: housing (residential investment). We visualize this below:

Consistent with intuition, our comprehensive business cycle approach outperforms the concentrated housing-only approach. We highlight this outperformance as it underscores the need to update more traditional leading indicator models to adapt to changes in the business cycle. Prior to the internet age, housing was the best way to generate macro alpha. Today, that role still exists but is smaller than it was previously. We will continue to prefer a comprehensive approach over a concentrated one. Currently, our Business Cycle Model continues to point to no risk of a downturn.

Yet, equity markets have sold off significantly, leading many, directly or indirectly, to turn to short-term momentum measures to reduce their risk or even short stocks. We visualize how a simple measure of short-term momentum had declined significantly in recent weeks to lows not seen since 2023:

The measure above captures the sign of every lookback period over the last six months to create a composite signal strength. Functionally, this is akin to trading 120 different binary trend signals on stocks. We use this approach as it avoids biasing our results to a specific lookback and captures the essence of short-term momentum.

Momentum is a persistent and pervasive phenomenon in markets. However, applying short-term momentum measures without any fundamental overlay can severely damage portfolios. We visualize how this short-term momentum signal described above has performed on a standalone basis.

As shown above, short-term momentum has not been a strong standalone signal. However, we find that adding a fundamental overlay improves the performance of such a strategy significantly.

This understanding is crucial today, as markets have moved significantly, but the business cycle has yet to show meaningful changes. To better understand what kind of expectations we can have for equity markets during such a mixed backdrop, we can leverage our programmatic understanding of economic conditions to recognize two regimes: One where the business cycle is expanding, but short-term momentum is negative, and the other where the business cycle is contracting and short-term momentum is negative.

Based on this regime recognition, we can create two portfolios. The first buys stocks when the business cycle is expanding, but the trend is declining. The second buys stocks when the business cycle and trend are both declining. We visualize these portfolios below:

As visualized above, when the business cycle is expanding, declines in short-term trends are buying opportunities. When the business cycle is contracting, declining short-term trends are short-worthy. Buying declining trends during an expanding business cycle results in a Sharpe Ratio of 0.28. Buying declining trends during a business cycle contraction results in a Sharpe Ratio of -0.17.

Today, while equity markets have begun to sell off meaningfully, our broad-based assessment of the drivers of the business cycle in the form of real investment, capital-intensive business output, and employment suggests that we are not headed toward a business cycle contraction.

While equity markets may not be headed into a bear market, they don’t need to head back into a strong bull market like 2024. As we noted in our update on equities on January 28:

We expect an upward market drift over the near future, but not one as strong or consistent as the returns we witnessed in 2024.

Until next time.

thank you from Italy!

Dropped a like before reading because I know I will like it. Keep the great work team.