Welcome to The Observatory. The Observatory is how we at Prometheus monitor the evolution of the economy and financial markets in real-time. The insights provided here are slivers of our research process that are integrated algorithmically into our systems to create rules-based portfolios.

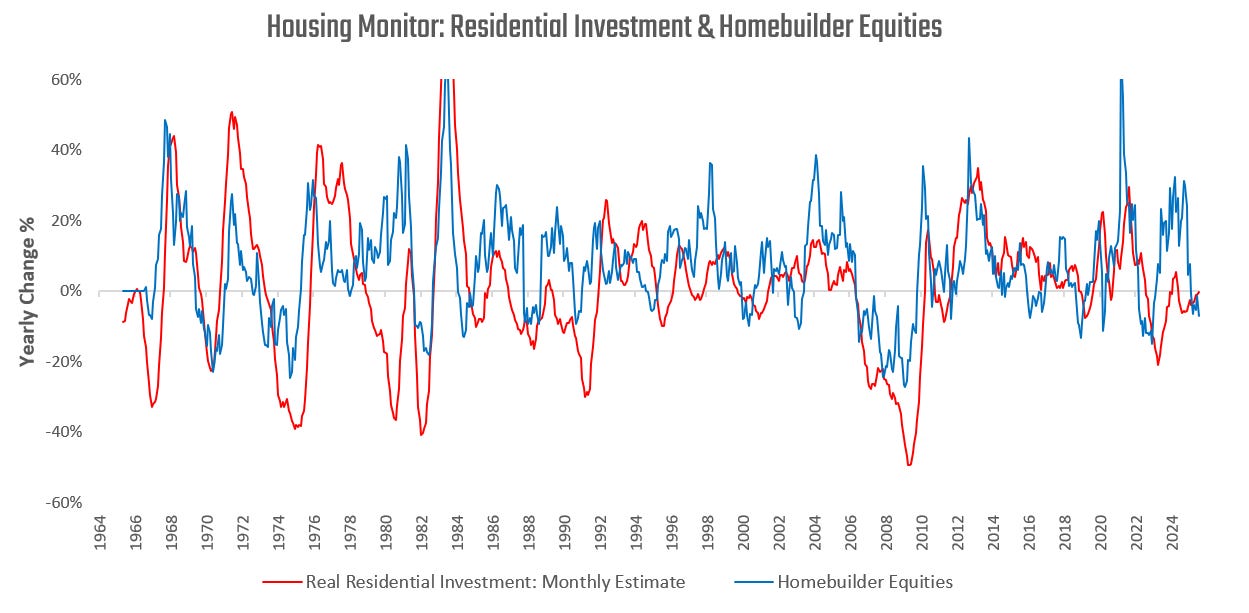

Homebuilder stocks have suffered in 2025 as weaker business cycle conditions and stalling housing activity have hampered the sector's sales and profit expectations. Recently, however, homebuilder stocks have bounced back marginally, suggesting a potential front-running of improving conditions. Using the systematic lenses developed for our Prometheus Homebuilders Program, we evaluate the macro forces driving current conditions in the sector to assess the durability of this bounce in homebuilder equities.

Our assessment is as follows:

Residential investment continues to wane, as mortgage apps, permits, starts, and completions continue to suggest weak activity.

This weak housing activity continues to weigh on the supply of new homes for sale, which continues to pressure homebuilder earnings expectations.

While macro conditions for the housing sector have not improved materially, earnings expectations have fallen considerably, significantly reducing the mispricing in the sector and reducing the short-side opportunity.

Fundamentally, our positioning remains biased towards